![]()

The same are in the nature of recommendation and not effective as yet.

We have divided the same into parts for the ease of understanding and referral:

4. Simplification in furnishing the mandatory requirement of Annual return and Reconciliation statement for 2020-21

3.

Cumulative Availing Credit as per GSTR2A for

April, May, June-2021

Present Provision

The GST credit availed in a particular month cannot exceed 105% of the

ITC reflected in GSTR2A of the respective month.

Amended Provision for April, May-2021 (Notf.13/21-CGST dt.1st May, 21)

The ITC which shall be availed in the GSTR3B of April-2021 and May-2021

shall cumulatively not exceed 105% of the total ITC reflected in GSTR2A of

April-2021 and May-2021.

Recommended Provision for April, May, June-2021

The ITC which shall be availed in the GSTR3B of April, May and June-2021

shall cumulatively not exceed 105% of the total ITC reflected in GSTR2A of

April, May and June-2021.

4. Simplification in furnishing the mandatory requirement of Annual Return (GSTR9) and Reconciliation Statement (GSTR9C- Formerly known as GST Audit Report) for F.Y.2020-21

5. Retrospective effect for

Interest on Delayed Payment of Tax to be charged on Net Cash Liability

Present Provision:

Through the Finance Bill, 2019 it was proposed that the interest on delayed payment of tax would be charged on Net Cash Liability i.e. the amount debited from the electronic cash ledger from the GST portal.

However, there were deliberations if this was to be give retrospective effect or prospective effect.

Recommended Provision:

In the

Finance Bill and also as per the recommendations, the interest on delayed

payment of tax liability shall be levied on the Net Cash liability.

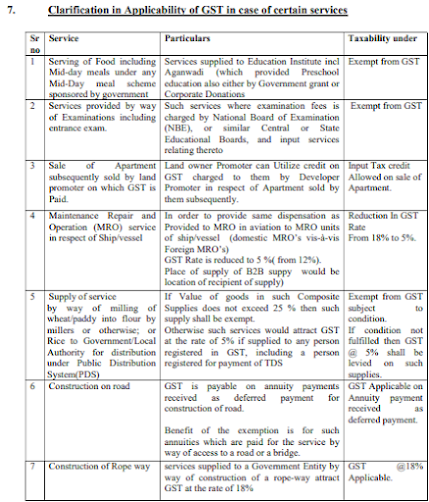

6. Relief in GST rates in case of COVID-19 related Medical Goods

Full exemption from GST has been recommended to be granted in case of items such as

Medical oxygen

Oxygen Concentrators

Other oxygen storage and transportation equipment Certain Diagnostic markers test kits

COVID vaccines

Amphotericin B and other such items (list to be notified in due course) for the treatment of black fungus, even if imported on payment basis, for donating to the government or on recommendation of state authority to any relief agency up till 31st August, 2021.

Initially IGST exemption was applicable only when the aforementioned goods were imported free of cost. This extension shall also be available till 31st Aug, 21.

GST rate on Diethylcarbamazine (DEC) tablets has been recommended for reduction to 5% (from 12%) in order to support the LympahticFilarisis (an endemic) elimination programme being conducted in collaboration with WHO.

Further relaxations have been recommended in case of repair value of re-imported goods such as sprinklers/ drip irrigation systems and other such components even if imported separately.

![]()

8. Extension for time limit for completion/ compliance of any action, by any authority or by any person

The time limit for completion or compliance of any action, by any authority or by any person, which falls during the period from 15th April, 2021 to 29th June, 2021 is extended up to 30th June, 2021.

Request you to kindly go through the above and kindly note that the

above provisions are yet to be notified.

No comments:

Post a Comment